SHANGHAI, June 29 (Xinhua) --- Morocco's BMCE Bank of Africa is busy preparing to open a branch in Shanghai in the third quarter this year.

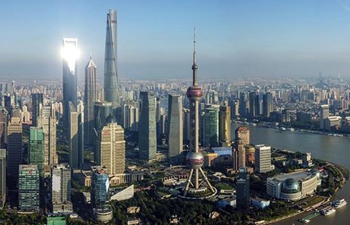

To take advantage of China's latest financial sector opening up, foreign financial institutions have accelerated their business operations in Shanghai, China's financial hub.

The Shanghai Banking Regulatory Bureau confirmed that a number of foreign banks have approached the municipal authorities and conducted market research to set foot in China. Some, like the Moroccan bank, have already sent their preparation teams to Shanghai.

Zhou Wenjie, deputy director of the bureau, said French Oney Bank has been working with Shanghai-based Bright Food (Group) Co., Ltd. to set up a consumer financial company.

Arab Bank of Jordan has applied to open a branch in Shanghai, which would be the first operating institution in Chinese mainland from the Jordanian banking system once approved by Chinese authorities, said Zhou.

China has announced measures to raise foreign equity caps in the banking, securities and insurance industries. A timetable to further open its financial sector was announced during the Boao Forum for Asia in Hainan Province this April.

"Because of China's massive market, foreign companies, especially financial institutions, are interested in setting up branches or subsidiaries in the country," said Said Adren, managing director of BMCE Bank of Africa Shanghai.

Foreign financial companies are already an important part of Shanghai's financial market. There are a total of 1,537 financial institutions in Shanghai, with nearly 30 percent set up by foreign companies. The city's financial market recorded a transaction value of 1,428 trillion yuan (216 trillion U.S. dollars) in 2017.

Shanghai Pilot Free Trade Zone announced new measures earlier this month to attract foreign banks, securities and insurance companies by adjusting restrictions on their proportion of stakes or range of business.

It pledged to promote reform and innovation in the financial sector, attract high-end talent, and further optimize the legal environment in line with international rules.

In May, JPMorgan Chase sent its application to set up a securities firm in Shanghai. UBS has applied to raise its stake in UBS Securities, while Japan's Nomura plans to set up a holding company, and Willis Insurance Brokers Co. Ltd. has been approved to widen its range of business in Shanghai.

"China represents one of the largest opportunities in the world for many of our clients and for JPMorgan Chase," said Daniel Pinto, Co-President & Co-Chief Operating Officer of JPMorgan Chase.

"It is a critical component of our growth plans, both globally and in Asia Pacific. Our scale and global capabilities give us the unique ability to help Chinese companies grow internationally and also bring foreign investment and capital to China," said Pinto.

According to a Moody's report, different from the past when more conservative and interest-margin-related products were preferred, foreign insurance companies now tend to innovate to fulfill the relative shortage where Chinese companies might not cover, motivated by China's new opening up measures.

Analysts from Moody's also said Chinese insurance companies can benefit by broadened industrial segments brought in by foreign institutions.

The Shanghai crude oil futures were the first crude oil future contracts open to foreign investors in Chinese mainland, and have become the largest-transacted crude oil future contracts in Asia since they were launched in March.

Lian Ping, chief economist of Bank of Communications, believes China's banking sector will introduce capital and management expertise from abroad by further opening up.

By the end of this April, total assets of foreign banks in Shanghai reached 1.5 trillion yuan, accounting for 10.3 percent of total assets of Shanghai's banking financial institutions. The non-performing loan ratio of foreign Banks in Shanghai is lower than the average level, which reflects a better quality of development.

With more foreign financial institutions developing their business in China, foreign companies can consequently lower their operating cost in the China market. The world can share the benefits created by China's financial market opening-up, said Ding Jianping, director of research center of modern finance at Shanghai University of Finance and Economics.

"Opening a branch in Shanghai will support trade and investment between China and Morocco and the whole African market," said Daniel Wu, head of business at BMCE Bank of Africa, Shanghai.